About Kevin

Kevin London is the Senior Vice President of the SightLine Investments Division with over two decades of experience as a trusted advisor helping investors make sound decisions to achieve their financial goals. Mr. London takes a particular interest in goal-based planning, disciplined portfolio construction and careful implementation to deliver the clarity, confidence and control enlightened market participants demand. In 2011 he formed SightLine Investments LLC, where he served as Principal and Investment Strategist. He later merged the company with Wealthcare Capital Management LLC to leverage the combined strength of a sophisticated planning technology platform and the principles-based, risk-managed, cost effective investment solutions his firm had established.

Mr. London began his investment management career as a private banker with Donaldson, Lufkin & Jenrette and its successor Credit Suisse First Boston. He later joined the Private Banking and Investment Group at Merrill Lynch where he served as a Personal Investment Advisor Portfolio Manager. Prior to his career in investment management, Mr. London held various senior management positions at FORTUNE and Gourmet Magazines.

Mr. London received his Masters of Business Administration from Northwestern University’s Kellogg School of Management and his Bachelor of Arts Degree from University of Richmond.

Why Wealthcare?

Established in 1999, Wealthcare Capital Management (Wealthcare) is a very different kind of a financial advisory firm. We pioneered a new way of providing financial life guidance, using Goals-Based Wealth Management. The cornerstone of our patented goals-based investing process is quite simply to help our clients, above all else, to make the most of their life.

We accomplish this by helping you understand and identify your most important life goals. And then we align your investments with those goals. Our process guides you through the myriad of changes in your life that will invariably require financial decisions. This is what we refer to as Financial Guidance for Life.

At Wealthcare, we measure our success in our clients’ fulfillment — one client at a time.

With our goals-driven investing approach, you will:

- Have your personal goals in complete alignment with your investments.

- Always know where you stand and we’ll present your progress reports in “plain” English.

- Have confidence in your ability to reach your goals, independent of market fluctuations and changing life circumstances.

Our Process

Wealthcare’s patented process is designed to help you reach your life goals, while minimizing unnecessary investment risk or needlessly sacrificing your life now.

Our process is dynamic and continual, as is life, and it will guide you through the entirety of your financial life.

MOST IMPORTANTLY, THE WEALTHCARE PROCESS IS YOU- DRIVEN. NOT MARKET DRIVEN. IT’S POWERFULLY SIMPLE. IT’S REFRESHINGLY CLEAR.

And it all STARTS WITH A GREAT CONVERSATION

A conversation that helps you to visualize your most important life goals

Dream Big

Do you like to travel? How will you pay for your children’s education? What exactly does “comfortable” retirement look like to you? You’ll cover these topics — and more — during our initial conversation.

We’ll use this conversation as a launching pad for creating your financial life plan. My objective as your Wealthcare advisor is to inspire and guide you toward pursuing the life of your dreams. I will help you define your life goals, and most importantly, will guide you toward achieving them.

But this is just a beginning. Wealthcare’s financial plan is not a “set it and forget it” tool. It’s a dynamic financial guidance system that evolves as your circumstances and financial markets change. I will continually monitor your plan against your changing life events and your investment portfolio, keeping the two in sync. Our software runs sophisticated market simulations, designed to monitor, measure and track your progress and report back to you with clarity.

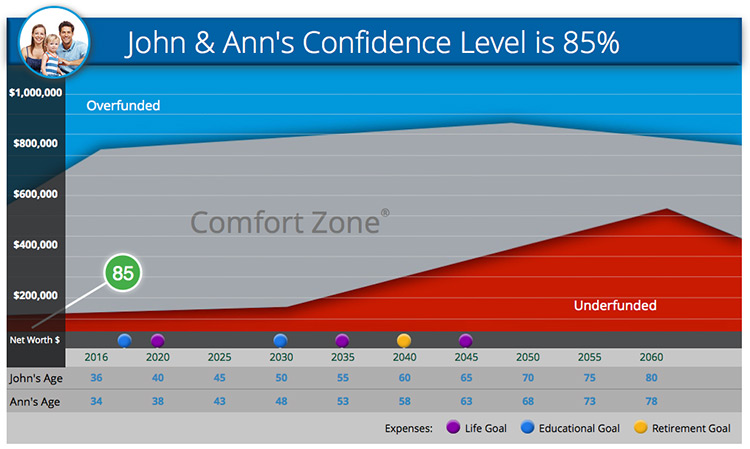

Your Comfort Zone®

You will have confidence in your financial life plan because I will be constantly performing analytics in an effort to ensure your success. At Wealthcare, we call this being in the Comfort Zone. The Comfort Zone measures the probability of reaching your financial goals. And it also alerts you if you veer off course.

John & Ann's Confidence Level is 85%

Overfunded

Comfort Zone®

Underfunded

Click on a goal to see more

This chart is for illustrative purposes only.

Stay on Course

The Wealthcare process is YOU-driven, not market-driven. As your circumstances, goals and priorities change, I will work with you to make appropriate adjustments. Whatever life events come your way — from expanding your family to buying a vacation home — I will monitor and measure each event against its financial impact on your plan.