About Jeffrey and Katrina Falke

Jeffrey Falke

Trust, Integrity, and Service are guidelines driving Jeffrey’s life inside and outside of business. Born and raised by a firefighter and hairdresser, Jeffrey has worked to and through college; he is no stranger to hard work. Jeffrey holds a B.A. in Finance and an M.B.A. and has represented top-tier firms, including, MFS Investment Management, Prudential, Nuveen, and Thrivent. This experience exposure equipped him for hands-on practical needs, including understanding various documents, contracts, wills, trusts, and other related paperwork. Many clients are simply seeking to develop a process and plan to transition from their business or executive position into a dignified retirement. They need advice on succession, risk management, and income for their lifetime – our specialty.

Jeffrey offers all areas of financial planning, estate planning, and benefits from Wealthcare’s robust planning, stress testing, and proprietary software systems (and teams) for high-level planning. Once in place, your portfolios are monitored and given a score of measurement to know where your plan rests on any given day. This helps reduce the stress markets can create when things are less stable.

Jeffrey obtained his first financial license in 1990.

Jeffrey’s wife and business partner, Katrina Falke, holds a B.S. in Chemical Engineering and is a big part of the planning aspect of our firm. Jeffrey and Katrina have three children, are foodies, and enjoy traveling and social events. Jeff speaks Spanish, fishes, surfs, hunts, and travels when possible. If you don’t see Jeffrey on a trout stream, he may be in a karate studio where he instructs Contemporary Martial Arts.

If you want to connect with Jeffrey to create your customized plan, call 706-376-2086 or email to jeff@thefalkegroup.com.

Katrina Falke

Our goal is to make estate planning, investing, retiring, and transitioning out of businesses and into life as smooth and easy as we can for our clients. Katrina offers comprehensive financial services, including strategic and tactical portfolio construction and management. Providing income while protecting or still growing assets is Katrina’s specialty.

Katrina has been a financial advisor for over 37 years. Katrina earned her BS in Chemical Engineering from the University of Kentucky and worked at Ashland Oil in the Engineering Dept. She quickly found her passion for mathematics and solving complex issues applied expertly in the finance industry. She started her career with Invest Financial (now LPL Financial) in the late 1980s as an advisor and supervisory principal. Katrina’s Series 7 and 24 (General Securities and Supervisory) are held through LPL Financial, and Series 66 (Investment Advisory) is held with Wealthcare Advisory Partners. Through Wealthcare, Katrina is able to offer her Advisory Clients two different platforms, LPL or TD Ameritrade.

Katrina relates her decades of experience to helping business owners, executives, and retirees reach their personal financial goals. Katrina has a detailed approach to planning and utilizes Wealthcare’s GDX360 system to support and guide the clients through a fact and stress-tested lifelong plan.

Katrina has three children, Lauren, Chase, and Megan, and a grandson, Liam. She loves traveling, cooking, reading, rescuing animals, and bird-watching. When she is not solving puzzles or fixing items that pose a challenge, you may find Katrina relaxing with her husband, Jeff, and their cat Lola.

If you want to get a customized plan for your life and family, call Katrina at 770-565-2125 or send an email to katrina@thefalkegroup.com.

Why Wealthcare?

Established in 1999, Wealthcare Capital Management (Wealthcare) is a very different kind of a financial advisory firm. We pioneered a new way of providing financial life guidance, using Goals-Based Wealth Management. The cornerstone of our patented goals-based investing process is quite simply to help our clients, above all else, to make the most of their life.

We accomplish this by helping you understand and identify your most important life goals. And then we align your investments with those goals. Our process guides you through the myriad of changes in your life that will invariably require financial decisions. This is what we refer to as Financial Guidance for Life.

At Wealthcare, we measure our success in our clients’ fulfillment — one client at a time.

With our goals-driven investing approach, you will:

- Have your personal goals in complete alignment with your investments.

- Always know where you stand and we’ll present your progress reports in “plain” English.

- Have confidence in your ability to reach your goals, independent of market fluctuations and changing life circumstances.

Our Process

Wealthcare’s patented process is designed to help you reach your life goals, while minimizing unnecessary investment risk or needlessly sacrificing your life now.

Our process is dynamic and continual, as is life, and it will guide you through the entirety of your financial life.

MOST IMPORTANTLY, THE WEALTHCARE PROCESS IS YOU- DRIVEN. NOT MARKET DRIVEN. IT’S POWERFULLY SIMPLE. IT’S REFRESHINGLY CLEAR.

And it all STARTS WITH A GREAT CONVERSATION

A conversation that helps you to visualize your most important life goals

Dream Big

Do you like to travel? How will you pay for your children’s education? What exactly does “comfortable” retirement look like to you? You’ll cover these topics — and more — during our initial conversation.

We’ll use this conversation as a launching pad for creating your financial life plan. My objective as your Wealthcare advisor is to inspire and guide you toward pursuing the life of your dreams. I will help you define your life goals, and most importantly, will guide you toward achieving them.

But this is just a beginning. Wealthcare’s financial plan is not a “set it and forget it” tool. It’s a dynamic financial guidance system that evolves as your circumstances and financial markets change. I will continually monitor your plan against your changing life events and your investment portfolio, keeping the two in sync. Our software runs sophisticated market simulations, designed to monitor, measure and track your progress and report back to you with clarity.

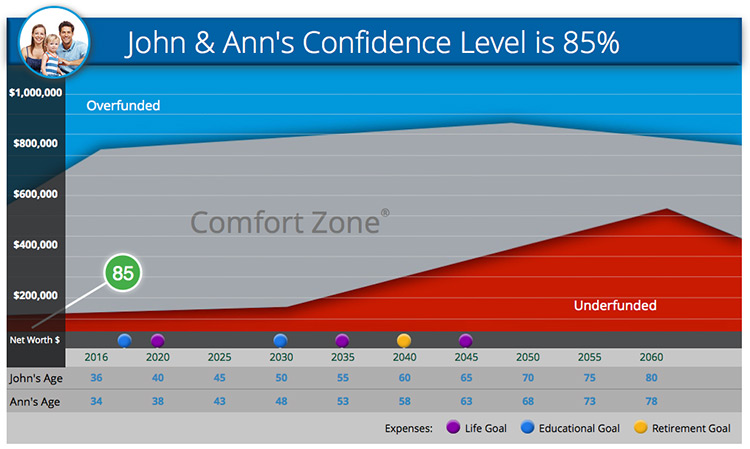

Your Comfort Zone®

You will have confidence in your financial life plan because I will be constantly performing analytics in an effort to ensure your success. At Wealthcare, we call this being in the Comfort Zone. The Comfort Zone measures the probability of reaching your financial goals. And it also alerts you if you veer off course.

John & Ann's Confidence Level is 85%

Overfunded

Comfort Zone®

Underfunded

Click on a goal to see more

This chart is for illustrative purposes only.

Stay on Course

The Wealthcare process is YOU-driven, not market-driven. As your circumstances, goals and priorities change, I will work with you to make appropriate adjustments. Whatever life events come your way — from expanding your family to buying a vacation home — I will monitor and measure each event against its financial impact on your plan.